10 Things You Should Know About Controversial Tax Reform Bills

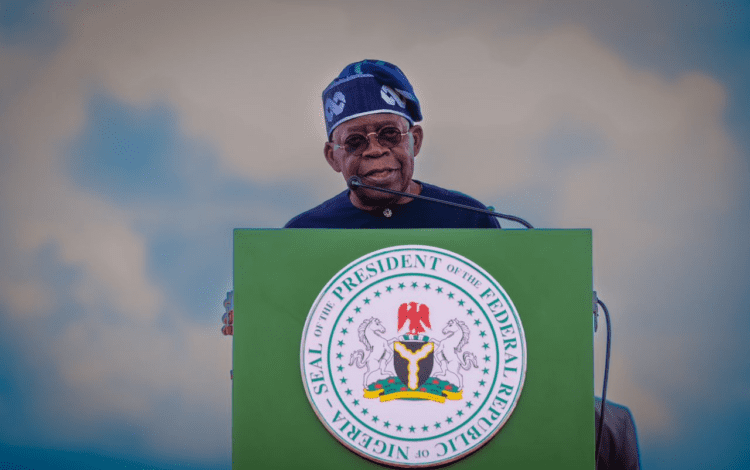

President Bola Tinubu’s recent engagement with the National Economic Council (NEC) on tax reform bills has sparked significant attention, particularly in the context of Nigeria’s economic landscape.

The NEC recommended that the current tax reform bills, which had already been presented to the National Assembly, should be withdrawn for additional consultations. While this suggestion has raised concerns and questions about the future of Nigeria’s tax reforms, President Tinubu has chosen to proceed with the legislative process, suggesting that amendments and public input can still be achieved without withdrawing the bills. By allowing the National Assembly to continue deliberating on the proposed reforms, Tinubu aims to strike a balance between inclusiveness and procedural progress.

The formation of a Presidential Committee on Tax and Fiscal Policy Reform in August 2023 was an ambitious move by Tinubu’s administration, aiming to overhaul Nigeria’s tax system in a manner that would enhance productivity, streamline operations, and provide a more conducive business environment. After extensive consultations with stakeholders across various sectors, the committee proposed four critical tax reform bills designed to modernize Nigeria’s tax operations. As these bills advance through legislative scrutiny, the president has shown openness to engaging further with stakeholders to address any remaining concerns or reservations about the reforms.

The NEC’s suggestion reflects a cautious approach, emphasizing the importance of widespread acceptance and comprehension of the proposed reforms.

The president’s response, however, demonstrates a commitment to moving forward with necessary tax changes while leaving room for continued discussion.

This compromise reveals the complex balance of prioritizing economic reform while respecting the input of governors, trade associations, professionals, and citizens across Nigeria.

Below, we unpack the major elements of the four proposed tax bills and what they signify for Nigeria’s future tax landscape. With these tax bills, Tinubu’s administration seeks to harmonize the tax structure across all levels of government in Nigeria, aiming for a simpler, more efficient system that aligns with global best practices. Each bill addresses a unique aspect of tax reform, from eliminating multiple taxes to ensuring efficient revenue distribution among federal, state, and local jurisdictions.

Here are ten key points to understand about these bills and their potential impact on Nigeria’s economy.

1. Nigeria Tax Bill: Reducing Tax Burden and Boosting Competitiveness

The Nigeria Tax Bill is one of the core pillars of the proposed reforms, targeting the elimination of multiple taxes that burden both businesses and individuals. In Nigeria, the issue of multiple taxation has long been a significant barrier to economic competitiveness, as companies face a complex web of overlapping tax requirements across various government tiers.

This bill proposes simplifying tax obligations, allowing businesses to operate more freely and with reduced administrative burdens, which could ultimately make Nigeria more attractive to investors.

By addressing multiple taxation, the Nigeria Tax Bill aligns with global practices where streamlined tax systems attract more investments and encourage local entrepreneurship. The bill’s introduction of a uniform tax framework could lead to increased transparency, providing businesses and citizens alike with greater clarity on their tax responsibilities.

Furthermore, the simplified tax obligations are expected to enhance compliance, making it easier for individuals and companies to fulfill their tax duties. With improved compliance, the government could see an increase in revenue without resorting to excessive tax rates.

This aspect of the reform is also crucial for fostering economic growth by reducing operational costs for businesses, particularly small and medium-sized enterprises (SMEs), which often bear the brunt of Nigeria’s complex tax system. Reduced taxation costs can translate into better profitability for these businesses, allowing them to expand, hire more employees, and contribute more significantly to the economy. Consequently, the Nigeria Tax Bill is poised to enhance economic productivity by creating a more supportive environment for businesses of all sizes.

For individuals, the elimination of multiple taxes could lead to an increased disposable income as they no longer face redundant tax payments. This would encourage consumer spending, which is vital for economic growth.

The bill also emphasizes equitable tax distribution, ensuring that individuals and businesses are only taxed once for their earnings, thereby enhancing fairness in Nigeria’s tax system.

In summary, the Nigeria Tax Bill is a proactive approach to simplifying tax obligations, which could lead to a more vibrant economy driven by local and foreign investments. By aligning Nigeria’s tax framework with global standards, the government is setting the stage for sustainable economic growth and development.

2. Nigeria Tax Administration Bill: Standardizing Tax Rules Across Jurisdictions

The Nigeria Tax Administration Bill (NTAB) introduces standardized tax rules to harmonize tax administration across federal, state, and local levels. Taxation in Nigeria has often been fragmented, with differing regulations and procedures across various jurisdictions.

This inconsistency has resulted in confusion among taxpayers and has complicated the compliance process. NTAB seeks to address this by creating a single set of administrative rules that apply nationwide, simplifying tax compliance for businesses and individuals alike.

One of the bill’s primary goals is to reduce administrative burdens by establishing a cohesive tax administration structure, which could help prevent overlapping tax demands. This unified approach is particularly beneficial for businesses operating in multiple states, as they would no longer need to navigate different tax regulations for each location. A standardized tax administration framework could also lead to more predictable revenue collection, as it provides a consistent approach to tax enforcement across all jurisdictions.

The NTAB also seeks to bolster transparency in Nigeria’s tax system. By creating uniform procedures, the government hopes to make tax obligations clearer to all taxpayers, thereby increasing trust and encouraging voluntary compliance.

For tax authorities, the bill enables a more organized approach to revenue collection, reducing the likelihood of errors or fraudulent practices that could result from a fragmented system.

Additionally, the NTAB encourages intergovernmental cooperation, facilitating better coordination between federal, state, and local tax authorities. This cooperation could lead to more efficient revenue distribution and enhance the financial independence of various government levels, allowing them to fund essential public services.

Moreover, the bill’s harmonization efforts could reduce administrative costs for the government, as it consolidates resources and reduces redundancy in tax operations.

In essence, the Nigeria Tax Administration Bill is a step towards a more integrated tax system that benefits both taxpayers and tax authorities by promoting efficiency, transparency, and compliance.

3. Nigeria Revenue Service (Establishment) Bill: Rebranding FIRS for a National Focus

The Nigeria Revenue Service (Establishment) Bill aims to reestablish the Federal Inland Revenue Service (FIRS) as the Nigeria Revenue Service (NRS), signifying a shift from a federal focus to a nationwide mandate. The NRS will be responsible for revenue collection across the federation, positioning it as the central authority for tax-related matters. This transition reflects an effort to unify tax collection practices and to make the agency’s role clearer and more comprehensive in scope.

Under this bill, the NRS will be tasked with overseeing the enforcement of tax laws, ensuring compliance, and streamlining revenue collection methods. The agency’s broadened mandate could lead to a more efficient revenue generation process, as it centralizes tax authority and reduces redundancy.

For taxpayers, the rebranding could signify a more approachable and organized entity that they can engage with for all tax-related issues.

By adopting a nationwide approach, the NRS also aims to strengthen accountability within tax administration. The unified agency would be able to monitor tax activities more closely, reducing opportunities for evasion and ensuring a fairer tax environment.

This could be particularly beneficial in reducing informal tax practices, thus maximizing revenue potential without increasing tax rates.

The NRS will also prioritize capacity-building within the agency to handle its expanded responsibilities. This includes training personnel, enhancing technological capabilities, and adopting modern tax collection methods. With these improvements, the NRS could provide a more responsive and taxpayer-friendly service, further encouraging compliance.

Ultimately, the Nigeria Revenue Service (Establishment) Bill is designed to enhance the government’s capacity to generate revenue efficiently and transparently, benefiting the country’s economic development.

4. Joint Revenue Board Establishment Bill: A Unified Platform for Taxpayer Rights and Dispute Resolution

The Joint Revenue Board Establishment Bill proposes the creation of a Joint Revenue Board, replacing the current Joint Tax Board, which covers only federal and state tax authorities. The Joint Revenue Board would represent a broader platform that includes all tax authorities across the federation, focusing on unified administration and taxpayer rights. The bill also introduces the Office of Tax Ombudsman, an independent body within the Joint Revenue Board tasked with protecting taxpayers’ interests and facilitating dispute resolution.

This new structure is intended to provide a more organized approach to tax administration, resolving issues that taxpayers may face in dealing with multiple authorities. The Tax Ombudsman will act as an intermediary, helping resolve complaints, addressing disputes, and ensuring that taxpayer rights are protected. This is a major step towards building taxpayer trust and creating a system that values fairness.

Furthermore, the Joint Revenue Board aims to reduce inter-jurisdictional conflicts in tax collection, minimizing disputes between federal, state, and local authorities. By creating a centralized body, the bill promotes a streamlined approach to tax collection, eliminating the confusion that often arises from overlapping tax regulations. This unified structure could also lead to more consistent enforcement of tax laws, reducing gaps in revenue collection.

The bill’s creation of the Office of Tax Ombudsman also signifies a shift towards taxpayer advocacy within Nigeria’s tax system. This office will be responsible for ensuring that taxpayers are treated fairly and that their concerns are heard, creating a more balanced and just system. The Ombudsman’s role in mediating disputes could lead to quicker resolutions, further simplifying the tax experience for Nigerians.

In conclusion, the Joint Revenue Board Establishment Bill represents a substantial reform that seeks to unify tax administration while safeguarding taxpayer rights and enhancing transparency in Nigeria’s tax system.

5. Overarching Objective: Streamlining Tax Coordination for Efficiency

The primary goal of these proposed tax reform bills is to create a more cohesive and coordinated tax system that eliminates overlapping responsibilities among federal, state, and local tax authorities. Nigeria’s current tax structure is plagued by inefficiencies, confusion, and a lack of coordination, which has led to issues in revenue collection and compliance. By streamlining tax administration, the government aims to foster a more transparent and predictable environment for both taxpayers and tax authorities.

The new reforms seek to clarify the roles of each level of government, reducing the chances of redundant tax claims and making it easier for taxpayers to understand their obligations. This approach aligns with the global trend toward integrated tax systems that improve transparency, increase revenue collection efficiency, and simplify tax compliance. For businesses operating across multiple states, this reform offers the promise of a consistent tax experience nationwide, removing much of the red tape that previously hindered operations.

These changes are expected to result in a more robust tax collection system that boosts the revenue base for all tiers of government without raising tax rates. As tax processes become more streamlined, the government can more effectively allocate resources to essential public services and development projects, ultimately benefiting the Nigerian populace. This coordinated approach also provides a clearer picture of revenue distribution and usage, which could strengthen public trust in the tax system.

Additionally, the reforms underscore the government’s commitment to creating an enabling environment for business, recognizing the critical role of the private sector in economic growth. By reducing tax-related complexities and fostering a more conducive environment for business operations, the reforms could potentially attract more foreign and domestic investments. Ultimately, these reforms lay the groundwork for a tax system that not only supports Nigeria’s economic goals but also fosters a more equitable society.

In sum, the overarching objective of the tax reform bills is to create a unified, transparent, and efficient tax administration that eliminates long-standing bottlenecks, boosts economic productivity, and strengthens Nigeria’s fiscal foundation.

READ: Tinubu Disagrees With Shettima, NEC, Insists On Tax Reforms

6. Integration of Multiple Taxes into a Unified Framework

One of the most ambitious aspects of the proposed reforms is the integration of multiple taxes, including Company Income Tax (CIT), Personal Income Tax (PIT), Capital Gains Tax (CGT), Value-Added Tax (VAT), and Petroleum Profits Tax (PPT), into a single, streamlined framework. This consolidation is aimed at reducing the administrative burden associated with maintaining separate tax laws and enhancing efficiency within the tax system. With this integration, the government hopes to make tax compliance simpler and more accessible for individuals and businesses alike.

The integration also promises to reduce tax overlaps, which have historically led to confusion and inefficiency in Nigeria’s tax system. By bringing all these taxes under one framework, the reforms could significantly lower the complexity of filing tax returns, making it easier for both individual taxpayers and corporate entities to meet their obligations. This unified structure also provides a platform for adopting digital solutions, such as electronic tax filing systems, which could further streamline tax processes.

Additionally, by unifying these taxes, the government aims to foster a fairer tax distribution that aligns with each taxpayer’s financial capacity. The integrated system can allow for clearer, more consistent guidelines that reduce the risk of arbitrary tax practices.

For instance, multinational companies operating across different sectors and regions would benefit from a single set of tax rules, ensuring a level playing field and improving Nigeria’s attractiveness as a business destination.

This integrated approach is expected to reduce revenue losses due to tax avoidance and evasion, as it becomes harder for taxpayers to exploit loopholes within a consolidated tax system. By simplifying the tax framework, the reforms can promote a higher rate of compliance, thereby increasing the tax revenue that can be allocated toward national development initiatives.

In conclusion, the consolidation of multiple taxes into a unified framework is a transformative step that seeks to make Nigeria’s tax system more efficient, fair, and easy to navigate for taxpayers, ultimately benefiting the nation’s economy as a whole.

7. Relevance of Stakeholder Consultations and National Economic Council’s Role

An essential element of these reforms is the inclusion of broad-based consultations with stakeholders, facilitated by the National Economic Council (NEC). The NEC, composed of representatives from all 36 states and chaired by the Vice President, plays a pivotal role in ensuring that the proposed reforms consider the unique needs and perspectives of various regions and sectors.

This council’s involvement adds a level of credibility and inclusivity to the reform process, allowing state governors and other stakeholders to provide input on the bills’ provisions.

The president’s decision to keep the legislative process active, despite NEC’s recommendation for further consultations, underscores his commitment to balancing progression with inclusiveness. By welcoming feedback from NEC members, President Tinubu ensures that the reform agenda remains in alignment with the country’s diverse socioeconomic landscape. This collaborative approach could help avoid potential backlash and make the reforms more widely acceptable.

Stakeholder consultations also provide a platform for addressing specific concerns raised by industry professionals, trade associations, and citizens. For instance, businesses concerned about the impact of new tax laws on operational costs can have their perspectives heard, leading to a more balanced policy. This process can also help clarify ambiguities, as input from a wide array of stakeholders can refine the bills’ language and provisions to reduce potential misinterpretations or misapplications of the law.

Through continued NEC engagement, the government demonstrates its willingness to listen and adapt the reforms as necessary. This process not only strengthens democratic governance but also builds public confidence in the reforms, as Nigerians see that their voices are considered in shaping policies that directly affect their economic future.

Ultimately, the NEC’s role in facilitating consultations highlights the government’s commitment to inclusive governance, promoting reforms that reflect the needs and aspirations of the Nigerian people.

8. Strengthening Nigeria’s Global Competitiveness

A critical motivation behind the tax reform bills is the desire to make Nigeria more competitive on the global stage. The current tax system, plagued by inefficiencies and a lack of transparency, often discourages foreign investors from choosing Nigeria as a business destination. By simplifying tax processes and aligning them with international best practices, these reforms aim to position Nigeria as a more attractive location for global business and investment.

The streamlining of tax obligations and the elimination of multiple taxes could enhance Nigeria’s ease of doing business ranking, a factor that significantly influences investor decisions. Simplified tax requirements would reduce the administrative burden on foreign companies operating in Nigeria, allowing them to focus more on their business activities and less on navigating complex tax regulations. This, in turn, could attract a broader range of foreign investments, driving economic growth and creating jobs.

Additionally, by establishing clearer and fairer tax laws, Nigeria can improve its reputation as a stable and predictable business environment. For international corporations, the assurance that tax policies are consistent and that compliance will not be hampered by unexpected changes is a significant advantage. This predictability can help Nigeria attract long-term investments that contribute to sustainable economic development.

The government’s emphasis on global competitiveness also reflects a broader strategy to integrate Nigeria’s economy into the global market. As the country strives to diversify away from oil dependence, fostering a vibrant private sector and attracting foreign businesses become essential. Through these reforms, Nigeria is taking concrete steps toward creating a dynamic, inclusive, and competitive economy.

In essence, the tax reform bills are geared toward reshaping Nigeria’s economic landscape by improving its global appeal, providing the country with an opportunity to attract high-value investments that could accelerate national development.

9. President Tinubu’s Vision for a Modernised Tax System

The tax reform bills represent a central component of President Tinubu’s economic vision, which emphasizes productivity, efficiency, and inclusiveness. The creation of the Presidential Committee on Tax and Fiscal Policy Reform in 2023 laid the groundwork for these legislative proposals, reflecting Tinubu’s commitment to building a modern tax system that supports Nigeria’s development agenda.

His approach combines ambitious reform with an openness to public input, indicating a leadership style that values both progress and democratic engagement. Tinubu’s vision includes a streamlined, tech-enabled tax system that can respond to the needs of a fast-evolving economy. The integration of modern technologies and the potential for electronic tax filing within a unified framework could lead to increased transparency and reduced opportunities for corruption. This vision reflects an understanding of the challenges facing Nigerian taxpayers and seeks to address them by fostering a tax environment that encourages compliance and enhances government accountability.

Additionally, the president’s focus on simplifying tax processes signals a commitment to reducing the barriers that have hindered economic growth in Nigeria. His administration sees tax reform not only as a tool for generating revenue but also as a foundation for creating a fairer and more competitive economy. This dual approach allows the government to pursue financial stability while also supporting the broader objectives of social equity and economic diversification.

Tinubu’s economic vision also includes a commitment to adapting Nigeria’s tax policies in response to feedback from stakeholders. This flexibility ensures that reforms remain relevant and effective, as they are continually shaped by the evolving needs of Nigerian citizens and businesses. Through these efforts, Tinubu hopes to establish a tax system that not only meets Nigeria’s fiscal needs but also aligns with the aspirations of the Nigerian people.

In summary, President Tinubu’s vision for a modernized tax system is a bold step toward creating a tax environment that promotes economic growth, social equity, and national development.

10. Looking Ahead: The Future of Nigeria’s Tax System

As Nigeria’s tax reform bills continue to move through the legislative process, the country faces an opportunity to transform its economic landscape. The success of these reforms will depend not only on the clarity and effectiveness of the proposed bills but also on the continued engagement of all stakeholders. While challenges remain, the reforms’ comprehensive approach and emphasis on inclusivity provide a solid foundation for positive change.

If the bills are passed, they could set Nigeria on a path toward a more transparent, efficient, and investor-friendly tax environment. This transformation has the potential to stimulate economic growth, reduce inequality, and position Nigeria as a competitive player in the global economy. The streamlined tax processes and consolidation of various tax types into a unified system would likely make compliance simpler and reduce costs for both businesses and the government. With this new tax structure, Nigeria stands to improve revenue collection, channeling funds more effectively toward public infrastructure, healthcare, education, and other critical areas for national development.

However, the real impact of these reforms will depend on implementation and the government’s commitment to maintaining transparency and accountability in tax administration. Clear guidelines, efficient tax collection systems, and accessible platforms for filing taxes will be necessary to ensure that the new system delivers on its promises.

Additionally, continuous oversight and regular reviews of the tax structure will help identify and address any emerging issues, ensuring the system remains adaptable to Nigeria’s changing economic landscape.

For the Nigerian populace, these reforms could represent a shift toward a more equitable society. By reducing the burden of multiple taxes and making tax obligations clearer, the government may improve voluntary compliance and foster a greater sense of trust in public institutions. With improved tax revenue, there could be more opportunities to fund social programs aimed at reducing poverty, enhancing public services, and promoting overall welfare.

Looking ahead, the Nigerian government’s commitment to constructive engagement with stakeholders throughout this process suggests a more inclusive approach to policymaking. By actively considering input from the National Economic Council, professional bodies, trade groups, and ordinary citizens, the government can build a tax system that resonates with the needs of Nigeria’s diverse population.

This inclusive approach is not only beneficial for the passage of the bills but also vital for ensuring long-term acceptance and success.

In conclusion, the proposed tax reform bills represent a significant milestone in Nigeria’s journey toward a modern, efficient, and inclusive tax system.

These reforms, if effectively implemented, have the potential to drive sustainable economic growth, enhance Nigeria’s attractiveness as an investment destination, and ultimately improve the quality of life for all Nigerians. With careful planning, continued consultation, and a commitment to accountability, Nigeria can look forward to a future where its tax system supports the country’s ambitions and strengthens its position on the global stage.

Source: Presidency

Sodiq Lawal is a passionate and dedicated journalist with a knack for uncovering captivating stories in the bustling metropolis of Osun State and Nigeria at large. He has a versatile reporting style, covering a wide range of topics, from politics , campus, and social issues to arts and culture, seeking impact in all facets of the society.