Tinubu’s One Year: The Economic Indices

As President Bola Ahmed Tinubu completes his first year in office, the economic landscape of Nigeria has seen substantial shifts marked by several notable indicators. His administration, which began on May 29, 2023, with a promise to rejuvenate the economy and uplift the citizens, has faced a myriad of challenges and opportunities.

One of the most significant changes has been the removal of the fuel subsidy. This decision, which was announced during Tinubu’s inaugural address, led to a dramatic increase in petrol prices. The cost of petrol surged from ₦238.11 per liter to ₦701.24 per liter, representing a 194.5% increase. Similarly, the price of diesel rose by 67.6%, from ₦844.28 to ₦1,415.06 per liter.

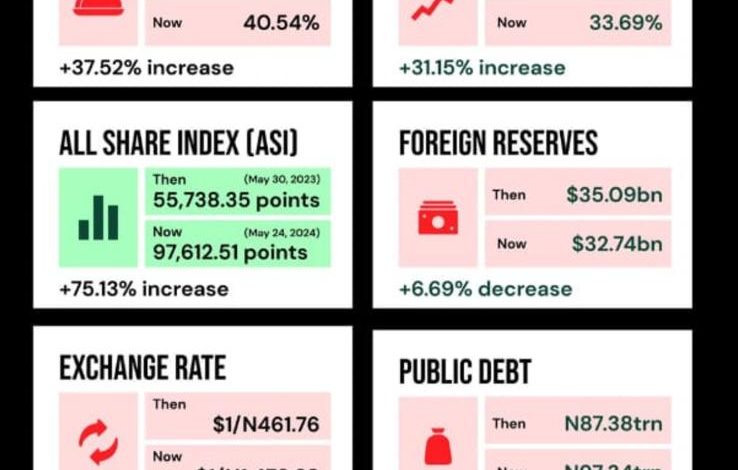

These price hikes contributed to a broader increase in the inflation rate. When Tinubu assumed office, Nigeria’s inflation rate stood at 22.41%. Over the past year, this figure climbed steadily, reaching 33.69% by April 2024. This rise is the highest since 1996 and reflects the broader economic pressures faced by the country.

Food inflation followed a similar trend, escalating from 24.82% to 40.54%. The sharp increase in food prices has made everyday life more challenging for many Nigerians, leading to increased calls for government intervention and support for vulnerable populations.

READ: Soldiers’ Murder: Tinubu Declares War On IPOB, Vows To Crush Non-State Actors

The exchange rate has also seen significant volatility. The naira depreciated drastically against the dollar, moving from ₦461.76/$1 to ₦1,479.69/$1, a 220.4% decline. This depreciation reflects broader issues in the foreign exchange market and has had a ripple effect on import-dependent sectors of the economy.

Despite these challenges, the Nigerian Stock Exchange’s All Share Index (ASI) showed a remarkable performance, increasing by 75.13% from 55,738.35 points to 97,612.51 points. This growth indicates a level of investor confidence and resilience in certain sectors of the economy, even amidst broader economic difficulties.

Foreign reserves, however, experienced a slight decline. Starting at $35.09 billion, reserves fell by 6.69% to $32.74 billion. This decrease highlights the ongoing challenges in maintaining a stable financial buffer amidst increased economic pressures.

Public debt has also been a point of concern. Over the past year, Nigeria’s public debt rose by 11.4%, from ₦87.38 trillion to ₦97.34 trillion.

This increase underscores the fiscal challenges facing the Tinubu administration as it seeks to balance developmental goals with sustainable debt levels.

Oil production, a critical sector for Nigeria’s economy, saw a modest increase. Production rose from 1.18 million barrels per day (bpd) to 1.28 million bpd, an 8.47% increase. This improvement is a positive sign, reflecting efforts to enhance production capabilities and stabilize the sector.

Interest rates, specifically the Monetary Policy Rate (MPR), saw a significant hike from 18% to 26.25%. This increase aims to combat inflation but has also raised borrowing costs, impacting businesses and consumers alike.

In terms of economic growth, Nigeria’s GDP growth rate improved slightly from 2.51% to 2.98%. While this growth is modest, it indicates some level of economic resilience and recovery amidst the numerous challenges.

President Tinubu’s administration has also focused on implementing palliative measures to cushion the economic impact on the populace.

These measures include cash transfers, education grants, and subsidies for critical sectors. However, the effectiveness of these measures in mitigating the harsh economic realities remains a topic of debate.

The economic policies and indices over the past year reflect a mixed bag of outcomes. On one hand, the administration has taken bold steps to address long-standing economic issues, such as the fuel subsidy and foreign exchange management. On the other hand, these measures have led to short-term economic pain for many Nigerians, evidenced by rising prices and inflation.

The significant increase in public debt and the depreciation of the naira highlight the need for more robust economic reforms and better fiscal management. These challenges underscore the delicate balance the Tinubu administration must strike between implementing necessary reforms and ensuring economic stability.

Investor confidence, as indicated by the performance of the All Share Index, suggests that there are sectors within the Nigerian economy that are thriving despite broader challenges. This resilience can be a foundation for broader economic recovery if harnessed effectively.

As Tinubu’s administration moves into its second year, the focus will likely be on consolidating these gains and addressing the persistent economic issues that continue to affect the Nigerian populace. Ensuring that the benefits of economic growth are felt broadly across the society will be crucial.

The year ahead will be critical for the Tinubu administration to demonstrate that its economic policies can lead to sustainable growth and improved living standards for all Nigerians. The administration’s ability to manage inflation, stabilize the currency, and reduce public debt will be key indicators of its success.

In conclusion, President Bola Tinubu’s first year in office has been marked by significant economic changes. While some indicators show positive trends, the overall economic environment remains challenging. The administration’s ability to navigate these challenges and implement effective policies will be crucial in shaping Nigeria’s economic future.

Sodiq Lawal is a passionate and dedicated journalist with a knack for uncovering captivating stories in the bustling metropolis of Osun State and Nigeria at large. He has a versatile reporting style, covering a wide range of topics, from politics , campus, and social issues to arts and culture, seeking impact in all facets of the society.