“Tinubu Na Thief”: Nigerians React As OPay, PalmPay Announce New Transaction Charges

Nigerians have taken to social media particularly on Twitter to express outrage following an announcement by OPay and PalmPay of a new ₦50 charge on electronic transfers of ₦10,000 and above, effective from September 9, 2024.

This charge, introduced in compliance with the Federal Inland Revenue Service (FIRS) regulation, has sparked widespread criticism, with many pointing fingers at the current administration.

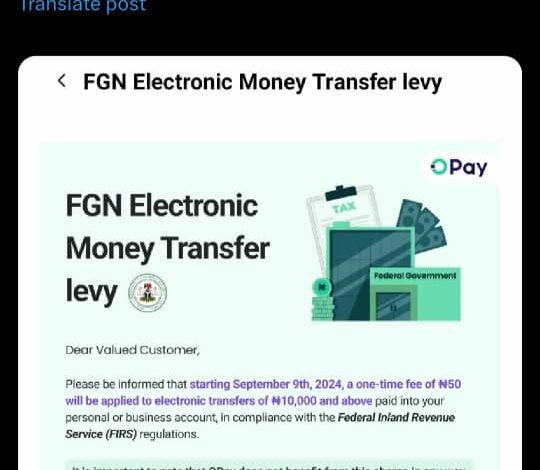

In a notice to its customers on Saturday, OPay explained the development, stating, “Dear valued customers, please be informed that starting September 9, 2024, a one-time fee of N50 will be applied for electronic transfer of N10,000 and above paid into your personal or business account in compliance with the Federal Inland Revenue Service regulations.”

The company was quick to clarify that these charges are mandated by the government and not for OPay’s profit, emphasizing that the levy is directed entirely to the Federal Government.

Similarly, PalmPay issued a notice to its users, highlighting the same regulatory requirements. “In accordance with the Electronic Money Transfer Levy (EMTL) regulation of 2022, a ₦50 levy will be charged on transfers of ₦10,000 or more paid into your PalmPay account from September 9th, 2024, as mandated by the Federal Inland Revenue (FIRS),” the statement read.

READ: Sep 7: Black Market Dollar To Naira Rate

PalmPay also noted that it does not benefit from the levy and reassured customers of its commitment to offering free transfers to any bank account.

The announcement quickly became a hot topic on social media, with many users venting their frustration.

A Twitter user, @Ninowhyt6, did not mince words, declaring, “Tinubu na thief,” in reference to President Bola Tinubu’s administration, which many hold responsible for the rising wave of taxes.

Another user, @Alaborn01, lamented how the fintech platforms were now following the same pattern as traditional banks. “I stopped using First Bank and other commercial banks because of this rubbish… Opay don later carry am come my doorstep,” he tweeted.

Several users saw this as part of a broader government strategy of excessive taxation. @Saviour4877 remarked, “Just got the mail, government is taxing everything, the money you send and the money you receive also.”

Others connected the issue to the political atmosphere, with @oactttt angrily commenting, “If we don’t kill APC, APC will kill all of us. Tinubu keeps taking and taking and taking. Dracula.”

Even users who had been loyal to OPay expressed disappointment. @temitopepr tweeted, “Even OPay no pay again. ????” while @Intellectual_OT accused the government of hurting OPay’s customer base, stating, “Federal government wants to ruin OPay mehn, they’ll make them lose customers… this is on all of you that voted for this government.”

Sodiq Lawal is a passionate and dedicated journalist with a knack for uncovering captivating stories in the bustling metropolis of Osun State and Nigeria at large. He has a versatile reporting style, covering a wide range of topics, from politics , campus, and social issues to arts and culture, seeking impact in all facets of the society.