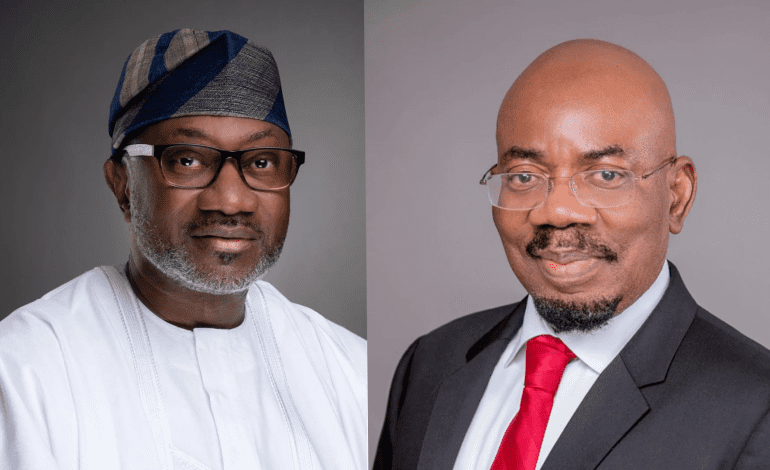

Zenith Bank Entangled In Multibillion Naira Scandal As Femi Otedola Exposes ‘Fraudulent Transactions’ (Photos)

A high-stakes financial controversy between billionaire Femi Otedola and Zenith Bank’s chairman, Jim Ovia, has intensified amid claims of unauthorised transactions totaling billions of naira.

According to TheCable, Otedola has lodged a formal complaint with the Force Criminal Investigation Department (FCID) accusing Ovia of illicitly using his company, Seaforce Shipping Limited’s Zenith Bank account for trading purposes back in 2011, without his consent or knowledge.

Although the account had been inactive since 2010, it was allegedly utilized for significant financial transactions. This revelation raises questions about the account’s dormant status and the bank’s oversight.

Zenith Bank has failed to provide the required documentation to justify these transactions, despite being requested to do so. This lack of transparency and accountability has further exacerbated the situation, prompting concerns about the bank’s practices and the legitimacy of the transactions in question.

The anomaly was discovered by Otedola recently after a whistleblower from Zenith Bank alerted him to these unauthorized activities.

READ: Heritage Bank: NDIC Begins Liquidation Process After CBN’s Licence Revocation

In a particular instance highlighted by Otedola, Zenith Bank acknowledged a debt of merely ₦2,278,420 in a 2018 correspondence to Seaforce’s auditors.

However, the bank statement from the same day indicated a substantially larger debt of ₦2.9 billion.

Further investigation by TheCable revealed transactions totaling over ₦16 billion charged against Seaforce’s account from 2011 to 2024.

The discrepancy includes substantial credits applied to the account on various dates in 2011, which Otedola claims were unauthorized.

As a result, Seaforce is currently saddled with a debt of approximately ₦5.9 billion, with a significant portion attributed to interest charges.

In response to these issues, Otedola and associated entities including Zenon, Luzon Oil and Gas, and Garment Care Limited have secured a federal high court injunction against Zenith Bank and several other financial institutions.

The injunction prevents these entities from trading with shares or paying dividends linked to the involved accounts until a motion for interlocutory injunction is heard.

The FCID has already begun interrogating senior officials of Zenith Bank as part of the investigation into this high-profile allegation of financial misconduct.

Sodiq Lawal is a passionate and dedicated journalist with a knack for uncovering captivating stories in the bustling metropolis of Osun State and Nigeria at large. He has a versatile reporting style, covering a wide range of topics, from politics , campus, and social issues to arts and culture, seeking impact in all facets of the society.